$$$ Cash Is King $$$

“Cash is King” – It’s a phrase that has been used countless times in the office and despite the commonness of the quote, there are really not three words that hold more truth when it comes to running a business. Cash can be the difference between a yes and a no answer, between a wrong and a right decision and between a peaceful or sleepless night. Money is like oxygen that the business needs to survive. Even the most successful business can fail without cash flow.

Cash is also the focus of the number one question that is asked during the tax exit meetings – “If the business made this profit, but where did the money go?”

The secret to being a smart business owner is to be informed – and being informed is easy. It’s as simple as looking at your income and expenses and checking when you expect to receive income and pay the expenses. Implementing that simplistic process for a 12 week future period will give you an indication of what balance you can expect in your bank account in 3 months time, how much GST you will owe and other cash obligations. This allows you to identify cash flow shortages or where excess cash will be available and in turn, assists you in making informed business decisions.

The phrase “cash is king” highlights the idea that having cash (liquid assets) provides financial flexibility and control, especially in times of uncertainty. Here are a few reasons why cash is considered “king” in finance and business:

1. Liquidity and Flexibility

- Immediate Purchasing Power: Cash is the most liquid form of asset, meaning it can be quickly used to take advantage of opportunities without needing to sell other investments or assets.

- Flexibility in Tough Times: During economic downturns, recessions, or financial crises, businesses and individuals with cash reserves can weather the storm more effectively. They have the ability to cover expenses, make investments, and manage risks when credit or financing might not be available.

2. Avoiding Debt

- No Interest Payments: Unlike loans or credit, cash doesn’t come with interest payments. Businesses or individuals who rely on cash instead of borrowing money avoid debt obligations, which can be especially beneficial when interest rates are high.

- Financial Freedom: Cash enables you to make decisions without being reliant on creditors or financing options, giving you more autonomy.

3. Ability to Seize Opportunities

- Investment Opportunities: Cash allows you to jump on investment opportunities when they arise, such as purchasing a property at a discount or buying shares during a market dip.

- Mergers and Acquisitions: In the business world, companies with ample cash reserves can acquire other businesses or assets more easily, often securing a competitive advantage.

4. Risk Management

- Buffer Against Uncertainty: Cash serves as a cushion in times of economic uncertainty or unexpected expenses. It helps businesses and individuals maintain operations or personal financial stability when revenues dip or unforeseen costs arise.

- Avoiding Forced Sales: If you have cash reserves, you’re less likely to be forced into selling investments or assets at a loss to cover short-term financial needs.

5. Bargaining Power

- Stronger Negotiation Position: Those with cash on hand often have a stronger negotiating position in both personal and business transactions. For example, businesses or individuals paying in cash can sometimes negotiate better deals or discounts.

- Vendor and Supplier Relationships: Businesses that pay suppliers in cash might gain better terms, discounts, or more favourable payment schedules.

6. Economic Cycles

- Protection During Economic Downturns: Cash can help businesses and individuals survive recessions when credit is tight, and other forms of financing may be harder to access.

- Asset Protection: In times of inflation or volatility in the stock market, cash offers a more stable form of value, even though it may lose purchasing power over time due to inflation.

7. Control

- Direct Control Over Your Finances: When you have cash, you don’t need to answer to creditors or be dependent on financing from external sources. This control can be especially important for entrepreneurs or small business owners who

want to keep their financial options open.

want to keep their financial options open.

8. Simplicity

- No Complexity: Cash transactions are straightforward, with no need to navigate complex financing structures, interest rates, or payment schedules. This simplicity can be an attractive feature for individuals and businesses alike.

9. Increases Confidence

- Financial Security: Having cash can provide peace of mind, knowing that you can handle unexpected expenses, emergencies, or downturns without scrambling for funds or taking on debt.

While cash is king, it’s important to note that it can be a double-edged sword in some situations, particularly in times of low interest rates or inflation. Holding too much cash for extended periods may not be the best strategy, as its purchasing power can diminish over time due to inflation. However, in the right context, cash provides flexibility, security, and opportunity.

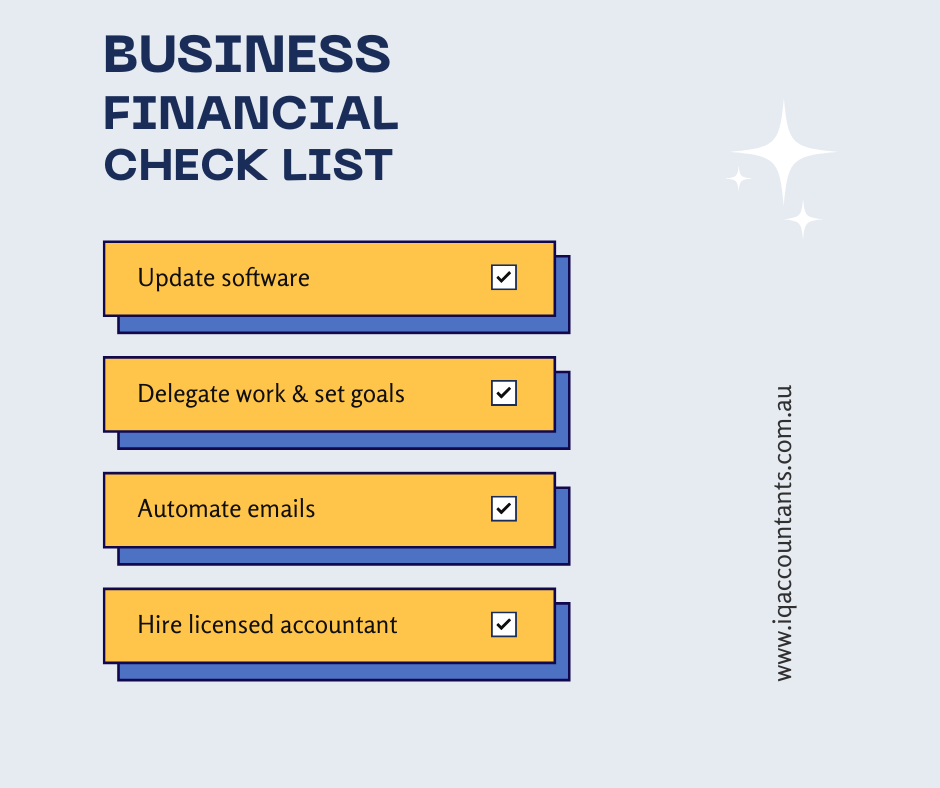

A cash flow can be done via excel spreadsheet or you can get in touch with us and find out about our advisory services. At IQ Accountants, we assist our business clients by offering solutions using cloud accounting packages and other available resources to ensure that you are meeting your goals. Call your local Gold Coast accountants today on .