Critical ways to minimise business tax debt

What are the best ways to minimise business tax debt you ask..

There are numerous awesome things about owning your very own business – You’re the master of your own destiny, you’re in control, and there are always new opportunities to keep growing. You have more personal freedom, too!

There are also downsides. One of the biggest being business tax. They say that in life there are but two certainties: Death and Taxes!

… In business, there are just taxes! Worse still, there are tax debts.

You can’t escape taxes when running a business – the two go hand in hand. The more successful you become, the more taxes you have to pay.

Doesn’t it seem as though you’re forever being punished for being a success? Extremely annoying!

However, taking care of your taxes is very important. You need to file them on time, and you need to work out exactly how much you owe. Any kind of mistake could be hugely costly, not just in times of finances, but also in terms of how much time it costs you.

This is where tax debt can soon pile up. It’s frustrating. Especially when the tax man comes-a-knockin.

Minimizing business tax debt in Australia involves a combination of proactive tax planning, effective management of existing liabilities, and strategic steps to reduce the overall tax burden. Whether you’re dealing with current business tax debt or trying to prevent it in the future, here are some practical strategies you can use:

1. Ensure Timely and Accurate Tax Filing

- Stay on Top of Deadlines: One of the easiest ways to minimize tax debt is to file your tax returns and BAS (Business Activity Statements) on time. Missing deadlines can result in penalties and interest charges, which can quickly add up.

- Keep Financial Records in Order: Accurate bookkeeping helps ensure that you only owe what you actually need to pay. Maintaining organized records of your income, expenses, and assets will ensure that you can claim all eligible deductions and avoid errors on your tax return.

2. Claim All Possible Business Deductions

- Maximize Your Deductions: Make sure you are claiming all business-related expenses to reduce your taxable income. Common deductions include:

- Operating expenses: Rent, utilities, office supplies, and insurance premiums.

- Depreciation: The depreciation of business assets like equipment, vehicles, and property.

- Employee expenses: Salaries, wages, and superannuation contributions.

- Interest on loans: If you have taken out a loan for business purposes, the interest paid may be deductible.

- Travel and vehicle expenses: Travel for business purposes, including car expenses, are deductible.

- Home office deductions: If you run a business from home, a portion of your home expenses (e.g., electricity, internet) may be deductible.

- Prepay Expenses: If you can afford it, consider prepaying certain expenses (such as insurance or rent) before the end of the financial year. Prepaid expenses can bring forward deductions and reduce your taxable income for the current year.

3. Make Use of Instant Asset Write-Off

- Instant Asset Write-Off: The Australian government allows businesses to instantly write off the cost of certain depreciable assets (e.g., vehicles, machinery, equipment) for assets that cost below a certain threshold. As of 2023, the threshold is $30,000 for small businesses (turnover under $10 million).

- Example: If you purchase a new asset for your business that costs $20,000, you can write off the entire cost in the current financial year, thus reducing your taxable income.

4. Set Up a Payment Plan for Tax Debt

- Negotiate with the ATO: If your business is struggling to pay its tax debt, you may be able to arrange a payment plan with the Australian Taxation Office (ATO). The ATO may allow you to pay your debt over time through installment arrangements. This can help reduce the financial strain and avoid penalties for non-payment.

- Contact the ATO Early: The key is to act quickly before penalties and interest accumulate. If you owe a significant amount in tax debt, working out a payment plan is often the best option.

5. Consolidate Your Business Debts

- Debt Consolidation: If your business has multiple debts, consolidating them into one loan could help you simplify your finances and secure a lower interest rate. This can free up cash flow to pay off tax debts and avoid additional penalties.

- Refinancing: Refinancing high-interest business loans or credit can also help reduce your debt burden and free up resources to pay your tax liabilities.

6. Review Your Business Structure

- Tax-Efficient Structures: Review your business structure regularly to ensure it is the most tax-efficient. Depending on the size and type of your business, restructuring as a company, trust, or partnership can offer different tax advantages.

- Family Trusts: A family trust can distribute income among family members in lower tax brackets, potentially reducing the overall tax burden.

- Company Structure: Companies are taxed at a lower rate than individuals (25% for small businesses in Australia as of 2023), which could be more advantageous if your business is growing and reinvesting profits.

- Self-Managed Superannuation Fund (SMSF): An SMSF can be used to accumulate retirement savings in a tax-efficient manner. Business owners may use their SMSF to hold property or other assets, with tax advantages like capital gains tax concessions.

7. Use Tax Losses to Offset Future Profits

- Carry-Forward Losses: If your business experiences losses in one financial year, you can use those losses to offset future taxable profits, reducing the amount of tax you pay in future years. This is especially useful if your business is cyclical and you expect higher profits in later years.

- Example: If your business incurs a $50,000 loss this year, that loss can be carried forward to future years to reduce taxable income when the business becomes profitable again.

8. Utilize Tax Offsets and Rebates

- Small Business Tax Concessions: Small businesses with an annual turnover of less than $10 million can access various tax concessions, such as:

- Simplified depreciation rules: The ability to immediately write off assets worth up to $30,000.

- Small Business Tax Offset: If you’re a sole trader, you may qualify for a tax offset, which can reduce your business’s tax liability by up to $1,000.

- Research and Development (R&D) Tax Incentive: If your business is engaged in eligible research and development activities, you may be eligible for the R&D tax incentive, which offers generous tax rebates or credits for innovation.

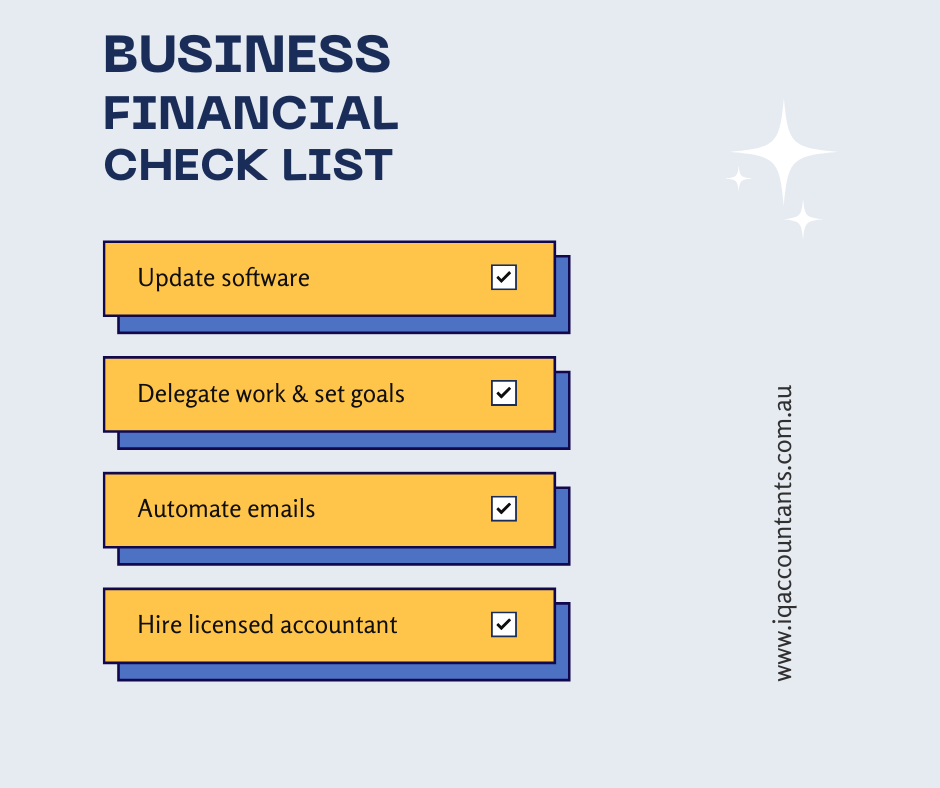

9. Seek Professional Tax Advice

- Hire a Tax Advisor or Accountant: The qualified accounting team at IQ Accountants can help you identify opportunities to reduce your tax debt, whether it’s through more efficient tax planning, strategic deductions, or identifying grants and incentives that you may be eligible for.

- Tax Planning for the Long Term: Working with a tax professional ensures that you can reduce your tax liability and plan for the future. They can also assist in managing tax debt and structuring payment arrangements with the ATO.

10. Improve Cash Flow Management

- Stay on Top of Cash Flow: A business with good cash flow can more easily manage tax debt and other financial obligations. Make sure your invoices are sent out promptly, follow up on overdue payments, and manage expenses efficiently.

- Build a Tax Reserve: Set aside a portion of your business’s income each month for tax payments. This can help avoid the buildup of tax debt and ensure that you have funds available to pay when tax obligations come due.

11. Avoiding Penalties and Interest

- Late Payment Penalties: The ATO applies penalties and interest for unpaid taxes. By paying your taxes on time, negotiating a payment plan, or applying for remission of penalties, you can avoid these extra costs.

- Remission of Penalties: If you’ve incurred penalties due to a genuine mistake, you may be able to apply to the ATO for penalty remission (especially if it’s the first time you’ve missed a deadline).

Final Tip:

The key to minimizing business tax debt in Australia is proactive planning, accurate record-keeping, and timely action. If you find yourself in debt, addressing it quickly by negotiating with the ATO or restructuring your finances can prevent the situation from worsening. Working with a tax professional can help you navigate the complexities of tax law, keep your business compliant, and ensure you’re minimizing your tax obligations as much as legally possible.

If this is all too much for you, simply call IQ Accountants on . We’re the local Gold Coast tax accountants many turn to in times of financial trouble or uncertainty. We look forward to helping you in your time of need!