4 Reasons to have multiple savings accounts

Having a savings strategy is important for achieving your long-term financial goals. It is wise to set your plan in place so that you can have a nest egg for a rainy day or future investment opportunities. One approach is to have multiple savings accounts to help you achieve your financial goals.

Here are five reasons to have multiple savings accounts:

Organisation

Savings can be difficult to achieve if you are not organised. By merely having multiple savings accounts, you can set goals for each one and witness productive results from a simple organisational switch. Consider what your desires are, look at the minimum balance requirements for competing banks, and decide which option fits your target and current financial circumstances.

Discipline

If you are determined to purchase your first home, having a savings account that is designated to that, can help. You can setup a schedule of deposits and track when you will be able to purchase the home of your dreams. This is also the same for your children’s education savings. Having different accounts will assist to make you more accountable for the money that you are spending, and your progress towards your long-term financial ambitions.

Multiple perks

Some banks offer perks for having several accounts with them. This can be in the form of a cash incentive, or a periodic interest rate that is given to you based on the amount of money you have in their account. Be sure to read the fine print and take advantage of bonuses that banks have on offer. Sometimes the perquisites can lead to additional capital for small investments if managed well.

BIG results

If you respond to positive success, then having separate savings accounts can boost your incentive to save because with hard work, you see your savings accounts growing. This will also keep you accountable if you did withdraw funds for something that was not a part of your savings strategy and your savings balance suffers as result.

Final remarks

After studying the five reasons to have multiple savings accounts, it is quite clear to see how they will help you achieve your financial goals faster. Be sure to carefully research interest rates and perks. Additionally, check to see which banks have withdrawal limits, if you are looking to have difficult access to your savings account. Positive results are also a motivational force to further incentive you to save wisely. Remember organisation is key when designing your savings strategy. By organising your savings goals well, it will help you to achieve your long-term financial plan with ease.

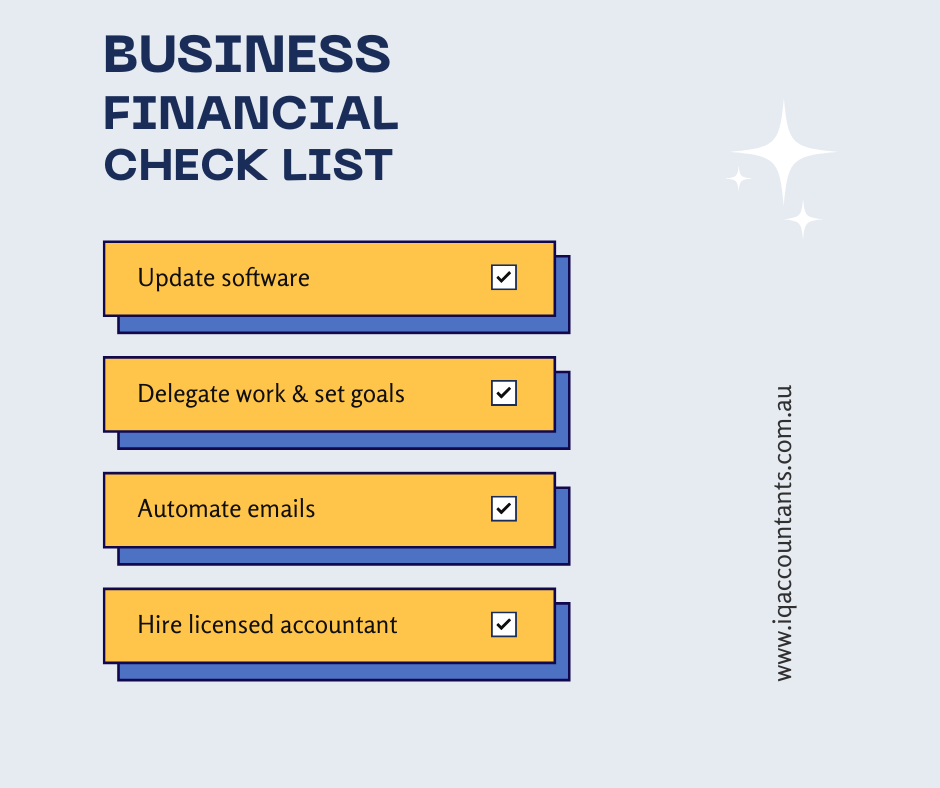

If you would like professional guidance from a licensed accountant on what you should do, whether it be – to open several saving accounts, or something else, contact the financial experts at IQ Accountants Gold Coast on 5576 0011. Our team can give you all the advice and support you need!